|

|

|

|

|

Have you checked your tax code?

Posted by Joy & Co Chartered Certified

Accountants on 19th March 2015

Since January HMRC have been issuing 2015-16 PAYE codes (also known as tax codes) to employees and those receiving private pensions.

Tax codes are used to tell employers how much tax should be deducted from your salary or pension before it finally hits your bank account.

It’s therefore vitally important that you check your tax code as soon as you get it to ensure that you’ll be paying the correct amount of tax.

Read

full posting >

|

|

|

|

|

|

| |

|

| |

|

| |

|

| |

|

|

|

|

|

Do I have to report rental income if the property’s making a loss?

Posted by Joy & Co Chartered Certified

Accountants on 15th November 2013

It seems that every year I pick up a new client who is in receipt of rental income that they’ve never reported to HMRC and now feel the need to set the record straight. Without exception their reason has been that the property wasn’t making any money so they didn’t think they had to report it. It seems that every year I pick up a new client who is in receipt of rental income that they’ve never reported to HMRC and now feel the need to set the record straight. Without exception their reason has been that the property wasn’t making any money so they didn’t think they had to report it.

So my aim here is to let you know why it’s a good idea, or indeed why you may have to report rental income even if you’re renting property at a loss.

If you are in receipt of gross rents of £10,000 a year or net rent of £2,500 then you must complete a self-assessment return to report this taxable income to our old friends HMRC. Gross rents means rental income before deducting allowable expenses. Net rents are after deducting allowable expenses.

Read

full posting >

|

|

|

|

|

|

| |

|

|

|

|

|

Landlords. Get what’s coming to you…

Posted by Joy & Co Chartered Certified

Accountants on 28th October 2013

As tax season is upon us the aim of this guide is to provide is to provide residential landlords with a prompt to ensure that you claim all that you’re entitled to when completing your tax return. As tax season is upon us the aim of this guide is to provide is to provide residential landlords with a prompt to ensure that you claim all that you’re entitled to when completing your tax return.

The logic is simple, the more expenses you claim, the lower your profit. The lower your profit, the lower your tax bill

Whether you’re renting your humble one bedroomed flat or have a portfolio of properties the principle is the same. So landlords, read this and be sure to get what’s coming to you.

Read

full posting >

|

|

|

|

|

|

| |

|

|

|

|

|

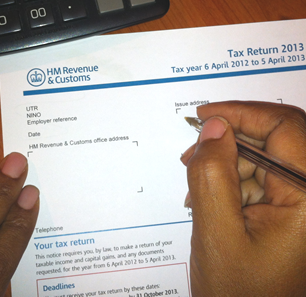

Self assessment

and the self employed

Posted by Joy & Co Chartered Certified

Accountants on 19th October 2013

If you started a business between 6 April 2012 and 5 April 2013 then you will have to file a self assessment return by 31 January 2014. From beginning to end the process can be broken down into the following steps: If you started a business between 6 April 2012 and 5 April 2013 then you will have to file a self assessment return by 31 January 2014. From beginning to end the process can be broken down into the following steps:

1. Get your UTR

2. Get an online account with HMRC

Read

full posting >

|

|

|

|

|

|

| |

|

| |

|

| |